5 ma daily is key on monday. To hold or not to hold. If the bears win, we see a rising 20 ma daily and that's bullish. So, always look at the bigger picture.

5 ma daily is key on monday. To hold or not to hold. If the bears win, we see a rising 20 ma daily and that's bullish. So, always look at the bigger picture.Sunday, February 28, 2010

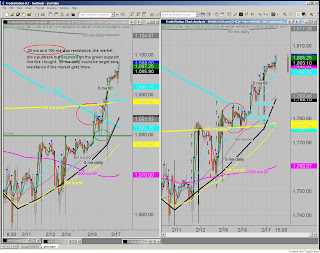

Fight between 5 ma and 50 ma daily....

5 ma daily is key on monday. To hold or not to hold. If the bears win, we see a rising 20 ma daily and that's bullish. So, always look at the bigger picture.

5 ma daily is key on monday. To hold or not to hold. If the bears win, we see a rising 20 ma daily and that's bullish. So, always look at the bigger picture.Friday, February 26, 2010

Thursday, February 25, 2010

Inside candle yesterday...

Wednesday, February 24, 2010

The 20 ma daily was and is still support...

Tuesday, February 23, 2010

Monday, February 22, 2010

Friday, February 19, 2010

The 50 ma daily was resistance indeed...

Wednesday, February 17, 2010

Tuesday, February 16, 2010

Saturday, February 13, 2010

20 ma daily important when the market gets there.

Wednesday, February 10, 2010

The relation between es, ym en nq is important.

Tuesday, February 9, 2010

Sunday, February 7, 2010

If the monthly wins, the market goes up again.

Friday, February 5, 2010

Thursday, February 4, 2010

Wednesday, February 3, 2010

Bulls were strong but....

Subscribe to:

Posts (Atom)